Developers love Stripe, and so do venture capitalists who continue to pour money into the payments startup to the tune of a $3.5 billion valuation. But how does something as unsexy as a payments company get so much love, hype and growth in a market dominated by incumbents like Google and PayPal? In this growth study we break down just how Stripe has found growth, including:

Existing Growth Levers

- Identifying a gap in the market between self-hosted payment processing options like Authorize.net and branded third-party processors like PayPal and Google Wallet.

- Building a “developer-first” product that makes it easy for companies and developers to accept payments immediately.

- A powerful word-of-mouth growth engine fueled by developer advocacy and relationship growth.

Future growth opportunities:

- Mobile payment processing

- Global payments and international growth

- Payment processing integration for existing platforms

Stripe Co-founders Patrick and John Collison via CNBC.

Introduction

In 2007, Y Combinator connected Patrick and John Collison with Harjeet and Kulveer Taggar, and the auction-management service startup Auctomatic was born. The following year, when Patrick was just 19 and John was only 17, Auctomatic was acquired by the Canadian domain name business Live Current Media (formerly Communicate.com) for $5M. [1] As part of the acquisition deal, the brothers relocated to Vancouver to work for Live Current Media. [2]

While Patrick was at MIT and John was at Harvard, the brothers began working on their next business venture in early 2010—a time when, as the company explains, “On almost every front, it was becoming easier to build and launch an online business.” [3] One area in which this was decidedly not the case was payments, which, as they knew well from their previous experience with eBay and other online retailers, “remained dominated by clunky legacy players.” [3]

The legacy players were difficult to work with both on the business and development ends. From the business side, getting setup and approved as a merchant on the platforms was time consuming and dominated by manual processes such as paper-based applications, phone audits and more. The developer-side was even more cumbersome–the companies lacked modern code bases, and things like APIs, client libraries and documentation were virtually non-existent.

The tools available to developers were so limited that the checkout experience for end users lacked the intuitive elegance of other core user experience areas. Taken together, it was clear to Patrick and John that there was a need for a developer-friendly payment company. That was the motivation for the company that ultimately became Stripe.

The startup was initially called /dev/payments and then officially incorporated as SLASHDEVSLASHFINANCE after learning that the state of Delaware doesn’t allow corporate names to have leading slashes. Yet the name resulted in innumerable misspellings—such as SLASHDEV/SLASHFINANCE, for example—and wasn’t as respectable as they would’ve liked. As CTO Greg Brockman explains on Quora, “Imagine being in talks with a very serious banker from a very serious bank and then telling them you worked at ‘Slash Dev Slash Finance’. It’s not a great way to build trust.” [4]

Not only that, but because Amazon’s similarly-named DevPay is a similar product in a similar space, they knew they had to go back to the drawing board to avoid any potential user confusion or trademark concerns. After ruling out both Stack (the domain was too expensive) and Forge (the name has some obvious negative connotations when it comes to finance), the name was officially changed to Stripe—quick and simple like the other names they had been interested in, yet free of any brand affiliations and full of positive connotations like racing stripes, striping across a RAID array, and the magnetic stripes on the back of credit cards.

The brothers eventually left school to focus on Stripe. [5] After a substantial private beta, Stripe officially launched in September of 2011. Seed funding was provided by Peter Thiel and Elon Musk—co-founders of the “clunky legacy player” PayPal—as well as Y Combinator, Sequoia Capital, Andreessen Horowitz, and SV Angel. [6]

In May of 2011, Stripe received $18M in Series A funding led by Sequoia Capital. A year later, they received another $20M in Series B funding from General Catalyst, Sequoia Capital, Peter Thiel, Elad Gil, Redpoint Ventures, Chris Dixon, and Aaron Levie. [7] Then in January of 2014, Stripe received an additional $80M in Series C funding from Founders Fund, Khosla, Sequoia, and Allen & Co. [6] In December of 2014, Stripe received another $70M in Series C funding from Sequoia, General Catalyst, Founders Fund, Khosla Ventures, and Thrive Capital. [17]

With 172more than 200 employees [19], a current valuation of $3.5 billion, and $200 million in funding, Stripe is now processing billions of dollars a year for thousands of businesses, and the company is well on its way to fulfilling the goal as expressed on the company’s website—increasing the GDP of the internet. [3] [17] But what exactly contributed to this monumental growth?

Initial Traction / Early Growth

A Payments Platform that “Doesn’t Suck” — Stripe Began With a Problem

John Collison asserts, “Stripe really did come about because we were really appalled by how hard it was to charge for things online.” [5] The goal behind Stripe was simple—create a payments platform that “didn’t suck.” [6] “It seemed clear,” their website explains, “that there should be a developer-focused, instant-setup payment platform that would scale to any size.” [3] According to John Collison:

“It’s easy to send a packet of information anywhere in the world, but sending money isn’t so easy … It’s a question of the economic infrastructure that’s underneath the web. We personally think that’s a really important problem–you have great connectivity at the information level but not at the payments level.” [8]

Stripe is the Collison’s solution to that problem. As John explained to CNBC, “Stripe is building payment infrastructure for the Web, so we make it easy to accept credit cards online. … Before Stripe, the way you’d do this is using the legacy banking structure. It was slow, it was complex, it was expensive. It had this very chilling effect on e-commerce.” He goes on to explain that Stripe, by contrast, “does all the heavy lifting in the background and just gives the company the product they want to use.” [9] As was to be expected, Stripe users were happy to relinquish the responsibility. As one early Stripe adopter raved in 2011:

“Stripe is a game changer. I’ve been using it for a few months and honestly its the best API I’ve ever used. The documentation is clear and concise. Its customized to your account so you can literally copy and paste and see the result. Just like it says, it gets out of your way. I was up and running and accepting recurring payments in less than an hour or so. I actually began to think of larger ‘swing for the fence’ type of ideas that I would have never considered if I were stuck to using Paypal because it was so painless. Looking forward to them eating every other payment processor’s lunch.” [10]

Stripe takes the notion of doing the heavy lifting seriously and it’s visible across all of the company’s products and support systems. For developers creating new platforms that require payments, the company has seemingly thought of everything. From robust documentation that makes it easy to get questions answered, to detail-oriented testing settings including a litany of test credit card numbers and response codes to a single click switch from test to production data in Stripe, to beautiful payment UI that’s available to anyone, Stripe has lived up to it’s goal to take the pain out of payments for developers. As it turns out, with Stripe doing all the heavy lifting, merchants and developers were no longer struggling to keep their heads above the water, meaning they were free to expend their energies on other, more enjoyable areas of business. But circumnavigating those clunky legacy players that serve as middlemen didn’t just make online payments easier for established businesses—it made getting off the ground more feasible for new businesses as well. For the Collison brothers, who claim to, “want to help put more websites in business,” this is the whole point. [6]

The Power of Delightful Experience

The Stripe team clearly puts the developer first, but it isn’t all about just making it easy for developers on the backend–the team is dedicated to making payments a delightful experience across the board. The end user making the payment is no exception. While most legacy checkout forms are clunky and cumbersome, Stripe has worked diligently to make it easy for developers and designers to build payment forms that are as elegant on the front end as they are efficient and functional behind the scenes. For the Collisons, the key to making it all work is code, as is evident from Stripe’s early developer-type names, /dev/payments and SLASHDEVSLASHFINANCE. “We believe that enabling transactions on the web is a problem rooted in code, not finance,” they explain. [6] And unlike the hard-to-use legacy systems with which Stripe is competing, Stripe is designed to be simple and effective for all parties involved. As Bill Alvarado, Lala cofounder (acquired by Apple in 2009), explains:

“You look at Google Checkout, you look at PayPal—they get in the way of the product. … In many ways, Google and PayPal are trying to create their own relationship with your customer. I think that’s the thing that Stripe has done right. We’ve designed this for fast use, yes, but also so that you can retain control of your experience, your product, and your customers.”

It’s true that site owners love Stripe because it allows them to keep customers on the site for the entirety of the checkout experience, as well as brand the checkout experience, store cards, enable subscriptions, and deposit payouts to bank accounts. Developers also love Stripe because it supports several programming languages and allows them to build their own payment forms. This combination of elegance on both the front and back end makes the developers and designers who use Stripe heroes to their companies, colleagues and peers. It also creates a seamless and intuitive payment experience that consumers love. [6]

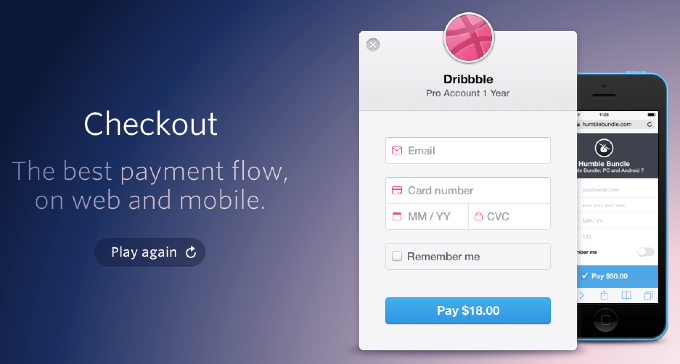

Stripe Checkout via TechCrunch

This attention to creating a delightful experience for the end user while making it a delight to work with the product on the backend has created a passionate fan base of advocates. Ask a product manager, designer or developer what payment system you should use to power your ecommerce site or mobile app and without fail, the recommendation will be Stripe.

Word of Mouth

Stripe benefited initially from the tight network of other Y Combinator companies who were looking for a payment platform that “didn’t suck”. A seemingly innocuous blog post from Y Combinator partner Garry Tan [16] was one of the first catalysts in Stripe’s early traction.

As with many truly delightful products, much of Stripe’s initial growth resulted from people who were excited to finally have an alternative payment method. After years of dealing with companies like Authorize.net and PayPal, developers were willing to try anything that helped them avoid the pain of another kludgy integration with either company. Patrick explained in an interview with TechZing in February of 2012:

“Initially [Stripe] very much spread through a word of mouth process. That was surprising to us because it’s a payment system not a social network so it’s not something you’d think would have any virality whatsoever. But it became clear that everything else was so bad and so painful to work with that people actually were selling this to their friends.” [11]

Not only did the company quickly learn that their initial assessment of available payment solutions was spot on, but also that the developers for whom they built Stripe were more than ready for an alternative—and they were happy to tell their friends about it. As the above testimonial from 2011 makes clear, a product that solves a problem for a lot of people can essentially sell itself.

Stripe seized upon the surprise word of mouth and worked hard to facilitate growth through the referral channel. The company sent care packages to developers who deployed live instances of Stripe. The launch packages included t-shirts, stickers, and other Stripe swag that only fueled the positive vibes developers had of the company. These t-shirts were worn proudly and the care packages shared on social media, mostly from developer recipients to other developers who they were connected to online.

Mobile Payments Hackathon via same

In addition to the swag, Stripe facilitated developer meetups, sponsored hackathons and other developer events, such as their Capture the Flag challenges [20], to build awareness and create a community around the product. These developer relations efforts weren’t just a marketing ploy–the company is completely oriented to making developers and designers successful. By building community, the company strengthened the referral network for Stripe and ensured that it would continue to be recommended and advocated for by developers everywhere.

Utility Driven Growth

While we’ve touched on this aspect briefly in the sections above, its importance to growth for a developer-facing business can not be understated. Stripe has invested incredible amounts of time, money and resources to building everything developers need to be successful and get up and running with Stripe. Their audience, developers who are crammed for time, demand excellence, and scrutinize products not on their marketing but on their merits, don’t respond to splashy campaigns–they respond to things that make their lives better and their jobs more efficient and quantitatively better.

With that in mind Stripe has created robust developer tools that act as marketing for the product because they are so much better than the alternatives. These include:

Detailed documentation – Most new products suffer from a lack of documentation. It’s often an afterthought and rarely considered as a marketing opportunity. Yet for developer-focused products, documentation is one of the most critical assets that you can create. Stripe’s documentation is so clear and well-written that it’s relatively easy for developers and non-developers alike to understand the API and associated products that come with Stripe.

Easy to read, thorough documentation makes the developer experience far better, saves developers inordinate amounts of time, and because it’s often lacking, earns the appreciation of developers who appreciate the effort to put their needs first, fueling word of mouth growth.

Client libraries – Client libraries are another area that can win over the hearts and minds of

developers. By creating and supporting libraries for the most popular programming languages, Stripe has made it easy for developers using any language to integrate Stripe quickly and seamlessly.

Without client libraries, a developer needs to invest time into writing basic functions to integrate and translate the API into their code base. Because it needs to be done for every project, this work is like re-inventing the wheel. With a client library the developer saves all of that time and instead focuses on the core product design.

Stripe offers client libraries for Ruby, Python, PHP, Java, Javascript, Node.js and many more, making it instantly accessible and functional for any of those popular development languages.

Testing environment – In addition to the documentation and libraries, Stripe has invested in creating robust testing documentation and functionality. From providing dozens of credit card numbers to test the payment gateway–including invalid cards that return specific error codes–to an entire test instance of the platform with every account, Stripe makes it easy once again for a development team to build with confidence and test the system thoroughly before deploying it to production.

User Interface – While Stripe is predominantly a backend solution, the company does provide elegant user interface elements that complement the product on the backend. These well-crafted design and interaction patterns and modules make it easy for developers who want to not just use Stripe as a gateway, but also as the front-end payment experience as well.

If you’ve ever paid for anything via Stripe’s checkout product, it’s likely you noticed. After all, few payment experiences ask for as little information as Stripe in such an elegant and simple way. Their hallmark design language is well regarded and emulated by designers and developers alike. The attention to detail in how well crafted these elements are earns them the same respect from designers and product managers as the thoughtful documentation does form developers.

The Developer Marketing Playbook

Taken together, Stripe has borrowed and innovated on what can only be regarded as the developer marketing playbook. Companies like Stripe, Dropbox, New Relic and others that are focused on creating a loyal customer base from arguably one of the hardest groups of people to reach on the planet, have turned to documentation, utility, community and product excellence to stand out among their competitors.

These assets, combined with a support organization of knowledgeable customer success engineers, private early access groups, meetups and a developer-first organization and approach create an authentic and valuable partnership between their customers and the products which results in loyalty and ignites word of mouth.

Product Launches

As the company gained users, Stripe also gained a better understanding of what those users wanted and needed. This led to subsequent product launches and integrations, that fueled growth in acquisition, activation and customer retention, including:

Stripe Connect – Released in October of 2012, Connect allows third-party services to integrate Stripe data and capabilities. At the time of launch, Fast Company referred to Stripe Connect as “the Facebook Connect for payments.” [18] Connect’s first users included Reddit, Shopify, and Skillshare.

Stripe Checkout – In January of 2013, Stripe released the first version of their Checkout, a complete payments UI that can be dropped into any site using a single tag. In March of 2014, Stripe updated Checkout to allow for one-click payments. [19]

Stripe Bank Transfer API – Launched in June of 2013, Stripe’s bank transfer API allows companies to not only accept payments, but also programmatically send payments to any number of service providers, sellers, vendors, and so on.

Apple Pay on Stripe – In September of 2014, Stripe launched an Apple Pay integration, enabling one-touch payments for iOS apps and eliminating the need for any manual typing of card or shipping details by the customer.

Company Culture

We’d be remiss in not mentioning the culture at Stripe, as it seems to inform so much of what they do and how they’ve grown. In discussions of the company culture at Stripe, one characteristic that comes up again and again is the singularness—it’s something employees seem to struggle to express. As Kickoff co-founder and Stripe acquihire Benjamin De Cock explains:

“I’ve always been freelancing. I’ve been working for a wide range of clients over the years and they were all very different. Stripe is no exception. However, I’ve never seen something that’s even close to Stripe.” [14]

Former Stripe employee Alex MacCaw echoes this sentiment:

“I’ve been at Stripe for a few months now, and I’ve wanted to write about what it’s like to work there. I’ve never been more impressed by the mechanics and culture of a startup. In fact, I’ve never seen anything quite like it.” [16]

Both MacCaw and De Cock see the company’s openness as a huge contributor to the overall company culture. De Cock asserts that everyone, including the company’s founders, is on the same level, explaining that at Stripe, “Nothing is secret and as a result, everyone stays deeply involved in the company, its progress and its culture.” [14] One way in which this complete transparency is accomplished is email. MacCaw claims that every email at Stripe, including one-on-one correspondence, is CC’ed to either the entire company or to particular teams. He provides an excerpt of the company’s internal wiki, which reads:

“It turns out that Stripe generates a lot of email. In most cases, this is quite an intentional, positive thing — it’s a great communication mechanism, persists forever, and is easily searchable. The reasons for CCing lists, is it’s a really low-friction way to keep everyone in the loop, and that way people can jump in with helpful advice.

It’s also a really good way to preserve openness as we grow (everyone still gets to see all the cool and important things that Stripe is up to) without requiring much extra effort.” [16]

Though this level of transparency can be demanding in terms of filtering, MacCaw explains that it allows him to “dip in and out of the company’s fire hose whenever I want,” while also keeping everyone at the company connected. MacCaw asserts, “I’ve never before seen this level of access or trust at a company. Other companies preach fearless communication. Stripe practices it.” This “fearless communication,” as MacCaw terms it, is only part of the equation. Stripe also organizes group activities—sponsored lunches, after-work drinkups and barbecues, company-wide hackathons—to promote a true feeling of community among employees. [16]

Yet, as both De Cock and MacCaw point out, all the above would be fruitless if not for the fact that the company seeks out the most talented employees it can get. De Cock refers to Stripe’s team as “insanely good.” [14] MacCaw claims:

“Hiring well is the key to all of this, and people are the foundation of any company’s culture. Frankly, I’ve never seen a team like Stripe’s; we have the best people in the industry. … When you hire great people, you can afford to give them a lot of autonomy.” [16]

For De Cock, it is this autonomy on the individual level that is particularly remarkable. He explains:

“The first thing you notice when working for Stripe is the absence of managers. This is really weird at first sight, especially as a freelance where you expect at least ‘someone’ to tell you what to do. No one is telling you what to do at Stripe. You just do. And people actually do a lot. Stripe ships like crazy. They have an extraordinary growth and customers are in love. As far as I can tell, everyone at Stripe deeply cares about the product. And you don’t have to manage someone who’s passionate.” [14]

By hiring great people and providing them with an enriching, rewarding culture in which to work, Stripe sets their employees up for success—not just on the individual level. Thanks to the company’s all-hands-on-deck transparency, employees feel invested and motivated to keep making Stripe better, which only serves to contribute to the company’s growth.

Future Growth

The Mobile Explosion

One of the biggest areas of opportunity in the realm of online payments is mobile. Put simply, many of Stripe’s competitors just don’t do mobile payments well, yet more consumers than ever are purchasing from their tablets and smartphones—and that number is only increasing.

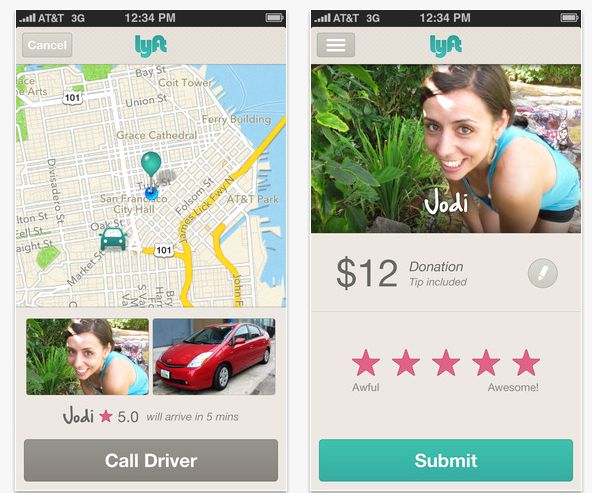

Stripe powers Lyft’s payments via smartplanet.com

Investor Keith Rabois (an early investor in two other big-name financial ventures, PayPal and Square) recognizes this significance, explaining, “Stripe’s opportunity is massive particularly because of explosion of mobile. … We’re just in the first and second innings of the mobile revolution, and it’s hard to quantify this but it looks like it’s going to be incredible for Stripe.”

Recent data seems to confirm Rabois’ claims. For example, according to IBM, mobile shopping accounted for 17% of Cyber Monday shopping in 2013—an increase of 55% over the previous year.[12]

To meet the growing need of mobile payments, Stripe introduced Checkout, a mobile-first payment front-end UX which makes it insanely easy to take payments from mobile phones. This thoughtful UX has led to mobile developers flocking to Stripe to handle payments not just via the mobile web, but via their native applications as well.

Big name and well-respected companies use Stripe to power their mobile payments, including Lyft, Dribbble and Instacart. As more commerce turns to mobile Stripe is well positioned to build on its leadership position in the space. The simple fact of the matter is that most of the other payment providers don’t have the design or product chops to deliver the kind of mobile experience that Stripe can. And while the competition will surely catch up, Stripe will continue to innovate, improve and win over mobile developers along the way.

A Global Approach

In many ways Stripe’s international reach is unsurprising. Not only are the Collison brothers themselves from outside the US, but so is nearly 40% of the company’s 85-person team. [6] Yet this isn’t the only explanation, or even the most compelling one, for Stripe’s global appeal. As frustrating as pre-Stripe online payments were, international ecommerce in particular constituted the biggest hurdle for developers, merchants, and consumers alike. Stripe’s impressive international growth is a direct result of removing the friction from this process.

And just as this international focus has been a boon to Stripe thus far, it will continue to play a critical role in their growth. John Collison explains,

“Creating this layer and modernizing payments infrastructure for the web is a big task … This means we have to expand to more countries, and potentially beyond credit card payments. We want to make payments work well for all merchants, all over the world.” [6]

Though Stripe is currently available for businesses in 13 countries—many of which are still in “stable and production-ready” beta [13]—and accepts 139 currencies, with a 2% currency conversion fee [14], they are nonetheless working to make their services even more accessible. Much of their most recent round of funding will be dedicated to this expansion, which includes hiring managers for each new country’s market, working with local banks, and adding to their engineering staff. [6]International expansion will undoubtedly continue to play a pivotal role in Stripe’s future growth.

Acquisitions, Ecosystem and Partnerships

The company’s first acquisition happened in March of 2013, when Stripe purchased the chat and task-management application Kickoff for an undisclosed amount. Founded by Benjamin De Cock, who did freelance design work for Stripe, Kickoff allowed teams to collaborate in real-time both on and offline with lists, file sharing, and messaging. [15] Yet since Kickoff has been maintained (though not updated) independent of Stripe, many speculate this was more of an acquihire of Benjamin De Cock and Kickoff developer Michaël Villar. [15] [13]

Stripe can tap into acquisitions as a way to grow the business while expanding the core product value. Because Stripe acts a platform rather than just a payment product, numerous companies are built on top of them to extend and customize parts of the experience not currently provided. For instance, companies like TKTK act as a layer on top of Stripe to provide greater details on reporting, while others modify Stripe’s behavior to make it easier to use for different business models.

Whether Stripe decides to pursue acquisitions or not, because it’s a platform it can enable these third party companies that have extended their product feature set. Much in the way Twitter fostered a third-party ecosystem to fuel early growth by enabling products such as TwitPic and TweetDeck, Stripe has the same opportunity to grow through these products.

Speaking of Twitter, In January of 2014, there was also mention of talks between Stripe and the social network regarding a potential e-commerce initiative. [6] While these talks have yet to bear any fruit publicly, they do point to the massive opportunity Stripe has to grow via high-profile partnerships where they power the payment portion for massive networks and platforms that are building new revenue products.

It’s still early days for Stripe, even with their massive valuation and developer advocacy fueled growth, they face a tough battle in a space with deeply entrenched and well funded competitors. The low margins of the payments business and the need to find the massive growth to justify the $3.5 billion valuation could prove to be challenging. Yet there’s no denying the powerful and sustainable engine of growth that Stripe has built. It’s an instructive case study for any business who has developers as their primary customer base and is looking to emulate their growth and customer loyalty.

Source : Here

For any inquiries about Specially regarding Startups in Toronto contact us at our website. Collaborative VisionZ always likes a healthy adventure!